How it works

Explanation of how the PNT Node Pool functions

Node Pool Specs

Token: pNetwork Token (PNT) Node Requirement: 200,000 PNT Pool Network: xDai Chain Pool Proportions: 1 PNT = 1 Pool Share Pool Rewards: PNT, ION Pool Reward Rate: 100% — 200% ION Allocation: 1% of total supply Reward Distribution: Proportional Minimum Stake: 100 PNT Collateral: Non-custodial Peerion Commission: 10% of rewards Operational Overhead: Subsidized By Peerion ($300+/month server costs & maintenance time)

Overview

The goal of the PNT Node Pool is to collect 200,000 PNT in order to stake in the pNetwork DAO and spin up a pNetwork Node to connect to the network. All contributors who Pool their PNT, become co-owners of the pNetwork Node and Shareholders/Members of the PNT Node Pool. Ownership and all coinciding rewards are split proportional based on Pool Shares. For every 1 PNT staked in the Pool, 1 Pool Share is received. While staked in the Pool, Shareholders also farm Peerion ION Tokens. Shareholders can stake the farmed ION back into the Peerion DAO for governance power over the entire ecosystem and additional reward claim. Learn more

Security: The Pool itself is governed by a DAO and acts as a multisignature vault, known as the Node Pool Vault. When there is a need to move assets outside of the Pool, a Gnosis Multisignature Safe is used. Peerion DAO acts as the delegate to establish the safe, and the Pool DAO acts as the other signatory. Therefore, control over the underlying collateral will always remain decentralized.

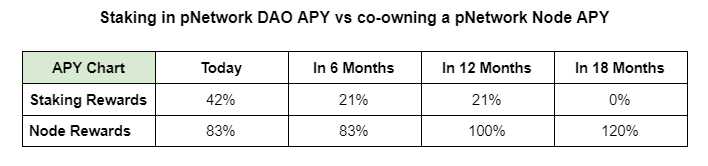

The PNT Node Pool has exposure to four types of rewards: 1. Staking rewards from the pNetwork DAO (42%-21% APY) 2. Peg-out fees from cross-chain asset/token transactions (0.25%) 3. Bidirectional fees for Portal (cross-chain meta) transactions (0.05% or $5) 4. ION farming rewards (100%+ APY) Learn more

Rewards Breakdown Year 1 08/2020–08/2021: 42% APY (in PNT) + 0.25% (Peg-out Fees) + 0.05%/$5 (Portal Fees) + 100%+ APY (in ION)

Year 2 08/2021–08/2022: 21% APY (in PNT) + 0.25% (Peg-out Fees) + 0.05%/$5 (Portal Fees) + 100%+ APY (in ION)

Year 3 08/2022 — Onward: 0.25% (Peg-out Fees) + 0.05%/$5 (Portal Fees) + 100%+ APY (in ION)

After year 2, the pNetwork DAO staking rewards come to an end, then only network fees are collected going forward.

Pool Fundamentals

pNetwork DAO Staking Rewards When 200,000 PNT is collected in the PNT Node Pool, it will be staked in the pNetwork DAO. The stake is required to act as a bond to connect the node to the network. Once the 200,000 PNT is staked, it will automatically be exposed to the DAO staking rewards. The staking rewards are 42% for year 1, and 21% for year 2. The rewards are in PNT and locked for one year from the date of receiving, and once unlocked they will be added to the PNT Node Pool. Staking rewards come to an end August, 2022.

pNetwork Transaction Fees Every time a peg-out transaction occurs for any pTokens on pNetwork, a 0.25% fee is taken. And when a peg-in/out transaction occurs for any pNetwork Portal, a 0.05% or $5 fee (whichever is greater) is taken. The fees collected are pTokenized versions of the native chain for the peg-out. For example, if a pBTC peg-out occurs, then 0.25% of the pBTC will be distributed to the PNT Node Pool Vault.

PNT Node Pool Distribution In the beginning, it is proposed that all node rewards earned be converted into PNT and added back into the PNT Node Pool Vault. The main reason this is proposed is to facilitate a buy-out option for existing Shareholders. It is important to note that once the 200,000 PNT is pooled and staked in the pNetwork DAO, it will remain locked until a Pool vote passes to shutdown the node. Therefore, it is necessary to offer an exit strategy for Shareholders. Existing Shareholders should be incentivized to allow buy-outs because it will increase the remaining Shareholders’ reward proportions going forward.

If the PNT buy-out pool is well stocked, a proposal can be made to diversify the Node Pool rewards with the various pTokens collected for transaction fees.

Buy-out Process A buy-out includes the initial PNT that was added into the Pool by the Shareholder when they joined and a proportional reward claim to anything in the Node Pool Vault. There are 4 steps to the buy-out process and a mechanism in place to handle it effectively.

Step 1. A Shareholder creates a buy-out request signal

Step 2. The other Node Pool Members approve the buy-out request

Step 3. The buy-out amount is sent to the Shareholder

Step 4. The Shareholder then burns their Shares and receives their proportion of the Node Pool Vault rewards

Loot, Looters & Lootings In the case that a Shareholder requests a buy-out and there are not enough rewards in the vault to cover it, there is a mechanism in place to enable a non-member to add capital to cover the buy-out in return for a reward share. This mechanism is called ‘Loot’. Think of Loot as a Share but without any voting power. In other words, a Loot is equal to a Share in regards to reward claim, but someone who owns Loot (a Looter) is unable to vote. This keeps the original co-owners of the Node in control of the Pool, but allows a swap in reward share in exchange for a Looter to cover a buy-out for a Shareholder.

Here is what the Loot process looks like:

Step 1. A Loot sale (Looting) is publicly announced

Step 2. The public bids up to the amount of Shares (Loot)

Step 3. The bids are voted on by the Shareholders

Step 4. A bid is chosen, the new capital is accepted and Loot is distributed

Step 5. The normal buy-out process begins

In the event that a Looting is required for a buy-out, the public will be able to bid on the reward shares for an allotted amount of time. The highest bidder is chosen when the bidding time expires. Looters can also receive buy-outs, but only based on a 1:1 Loot to PNT ratio.

In other words, if a member needs a buy-out for 10,000 Shares, a potential Looter can bid 11,000 PNT to cover the buy-out and receive 10,000 Loot in return, and the extra 1,000 PNT is added to the Pool Vault as an entrance fee. Then if that Looter would want a buy-out, they would only receive the 10,000 PNT back, and can then exit by burning their Loot for a proportional share of the rewards in the Pool Vault.

Reward Airdrops All rewards collected from PNT Node Pool activity are deposited into the Pool Vault. There is obviously a need for profits to be realized by the Shareholders and Looters. A proposal for scheduled or random airdrops can be made by any Shareholder, which initiates a vote that must be majority approved by the other Shareholders. If approved, the proposed amount of rewards will be allocated for distribution and all Shareholders and Looters will receive their proportional reward share.

*The initial proposed rewards distribution schedule is set to airdrop rewards every 30 days.

The airdrop works by sending the reward allocation to the Peerion Nimbus Sender and using the Disperse multisend dapp. A snapshot will be taken at the proposed time to determine current Shares and Loot proportions. The airdrop must be approved by the Pool DAO in order to be distributed.

Node Earnings and Projections In order to become a pNetwork Node, 200,000 PNT must be staked in the pNetwork DAO, which earns 42% APY in staking rewards until August 2021. After that point, the APY is cut in half to 21% APY and remains so until the staking program is terminated in August 2022.

Once the 200,000 PNT is staked in the pNetwork DAO and the pNetwork Node is deployed, the Node will start earning 0.25% on peg-out transactions, and 0.05% or $5 (whichever is greater) for all pNetwork Portal use in both directions (peg-in/out).

30-Day Earnings Per Node + 12 Month Projection Assumptions: PNT price is kept stable to display staking rewards in $, nodes count double in six months and triples in twelve) Staking rewards will be halved in August 2021 (source: pNetwork Node Pitch Deck)

Assumptions: PNT price is kept stable to display staking rewards in $, nodes count double in six months and triples in twelve) Staking rewards will be halved in August 2021 (source: pNetwork Node Pitch Deck)

To analyze all current node data visit: https://pnetwork.watch/

Conclusion With the high threshold of 200,000 PNT to become a pNetwork Node Operator, it is difficult for one to achieve alone. Peerion’s PNT Node Pool offers an easy entry point with only a minimum contribution of 100 PNT. The pNetwork DAO staking rewards will come to an end by August 2022, and co-owning a pNetwork Node is a way to not only continue receiving rewards, but support pNetwork into the foreseeable future.

With that said, Peerion makes it very easy to become a pNetwork Node co-owner right now, with no technical skills required. Peerion maintains the server that the node runs on and subsidizes the server overhead costs. To become a pNetwork Node co-owner, it is as simple as staking in any other pool.

Peerion PNT Node Pool https://peerion.io/pools/pnt/

Last updated